xijian/E+ via Getty Images

Lede

The Ondas Holdings Inc. (NASDAQ:ONDS) story is a long one, based in mission critical infrastructure, the fog cloud, rail, and drones. The company has tremendous upside and with it, tremendous risk, but the most recent earnings report was exceptionally strong.

Q4 Earnings and Notes – Quick Hit

Ondas guided to the following for 2022 on its latest earnings call on 3-22-2022:

-

~10x bookings in 2022 vs. 2021 ($20M vs. $2M).

-

2024 revenue ~75x 2021.

-

The Rail side of the business will be self-funding / profitable by the end of 2022 and all of 2023.

-

American Robotics (AR) is well ahead of schedule with 30 contracted drones by 3-22-2022, compared to an initial guidance range of more than 50 by year-end.

-

Five of six class I rails will be contracted by the end 2022, with the second announced on the call and a third expected in Q2.

-

For a speculative entity, this is about as good as it gets. But it doesn’t make it not speculative.

With the class I rails on board, Ondas is stepping close into the runaway technology position: a position where there are no natural competitors and industry buyers are few in number, massive in power, exceedingly technologically savvy, and they have circled the next winner.

Preface

Security and performance restrictions require private mission-critical wireless networks that are separate from the public internet and privately managed.

Mission-critical tasks like providing power (utilities), protecting citizens (first responders), and responding to disasters need reliable networks to be effective.

As an example, the utility industry cannot compromise connectivity. Communication with personnel and devices needs to go through successfully, without interference, even in rural or remote areas.

Similarly, utility networks cannot afford downtime.

Commercial public cellular networks don’t offer the levels of reliability, availability, latency, and security that mission-critical services require.

Designed primarily for the consumer market, commercial cellular networks tend to focus the majority of their resources on urban, more populated areas, where consumers use high-bandwidth connections.

This is why organizations have relied on their own private networks.

Other mission critical industries, like rail and security (police, fire) face the same connectivity and security requirements.

But, recently, these private mission-critical networks have evolved with the rest of technology, meaning that new services have caused an exponential increase in data communications. This has caused a strain on the capacity of many existing infrastructures.

• Ondas is a provider of a software defined network — an edge (or ‘fog’) cloud specifically for private mission-critical wireless markets.

• The company does operate, in part, under a software as a service (SaaS) model which is recurring revenue for what will likely be a portion of its business.

• The recurring revenue is intended to lead to high margins, strong visibility and a capital-light business model.

• The company claims that its thirteen years of software development provides a first mover advantage along with ownership of two IEEE standards (the rules and guidelines that define communication for wireless LANs) and 14 patents.

• The total addressable market is about $50 billion.

• The company had less than $3 million in revenue in the last year.

• The company just guided to $20 million in bookings for the rail side of the business, ostensibly a 10x from 2021. Further, the CEO noted that $100 million in 2024 revenue was within the realm of possibility. This is just the rail side of the business.

• Ondas acquired American Robotics, the first and only drone company to receive FAA approval for its drones to be flown beyond the visual line of sight (BVLOS).

• Guidance given on 2021 for AR called for over 50 drones (called Scout) to be delivered in 2022, over 800 in 2024, and over 4,000 in 2026. AR has disclosed that each Scout runs at a 70% free cash flow margin, and a payback in less than one-year. Each Scout is sold as a five-year contract for $50,000 a year.

• Ondas has several market opportunities but the most relevant to the near-term are:

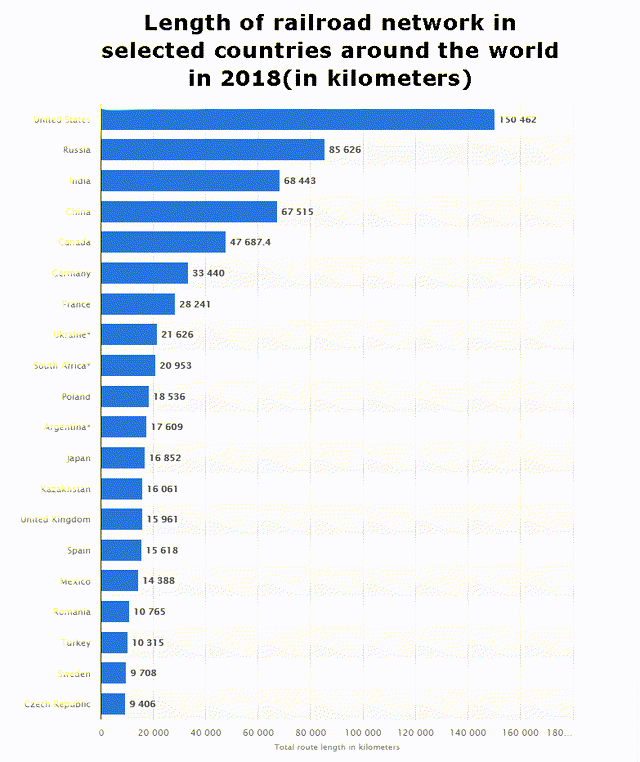

– Rail networks: The U.S. rail system stretched across almost 150,500 km, making it the largest network in the world as of 2018. The Federal Communications Commission (FCC) has set forth a requirement that their networks be upgraded by 2023.

Ondas already has a partnership with blue chip Siemens for its large install base of rail customers.

We learned on the Q4 earnings call on 3-22-2022, that now two of the six Class I rails have signed purchase orders with Siemens (OTCPK:SIEGY) for the Ondas offering. The company also gave guidance that it expects five of the six to do so by the end of 2022, with an imminent third to come in Q2 2022.

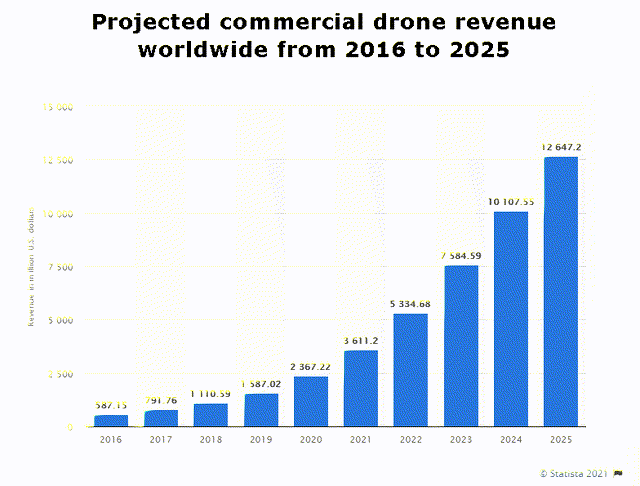

– Commercial drone network: By 2025, the commercial drone market is expected to generate just over 12.5 billion U.S. dollars in global revenue.

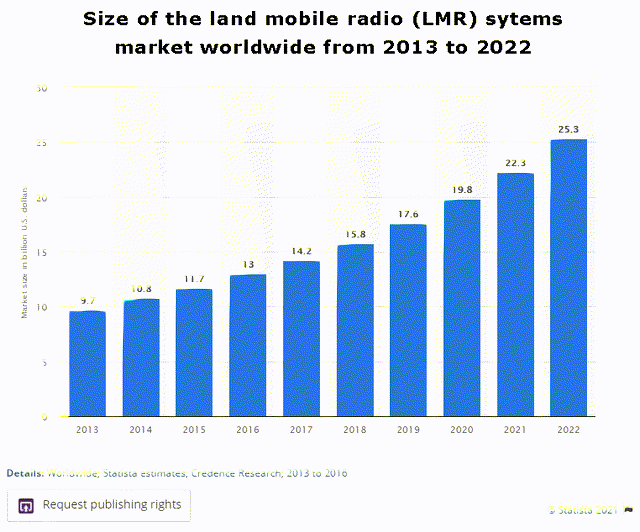

– Land mobile radio (LMR) network: In 2022, the global market for land mobile radio systems is projected to reach 25.3 billion U.S. dollars. This system needs upgrades.

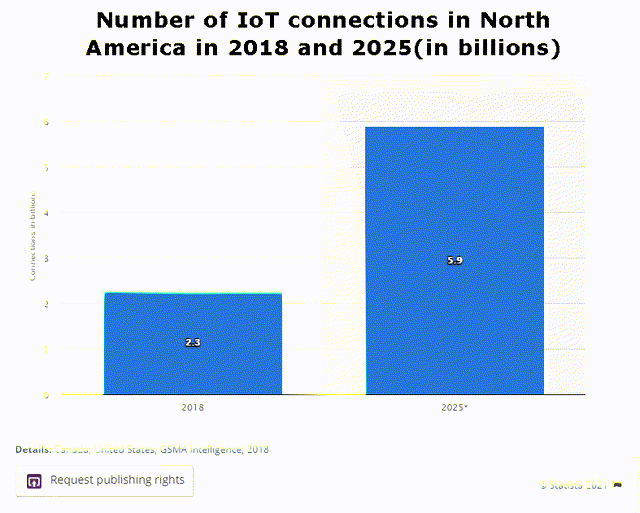

– Generally, the Internet of Things (IoT) device connectivity: By 2025 the number of IoT connections in North America is forecast to grow to 5.9 billion.

Story

In short, Ondas provides wireless connectivity solutions for private industrial internet applications, typically located at the network edge, and now with American Robotics (AR), the one and only drone approved by the FAA for flight BVLOS.

Let’s start with the network, first — the “not AR” business.

The platform provides broadband solutions to private mission-critical industries that have also functioned on narrow-band networks. That has to change — technology requires it, as does the FCC in many cases.

The company operates, partially, under a software as a service model which is recurring revenue. The recurring revenue is intended to lead to high margins, strong visibility and a capital-light business model.

The CEO has communicated to me that the long-term EBITDA margin goal is over 30%, which is very much like the other software Top Picks we cover.

The company’s software platform integrates Fog-computing with intelligent sensor-based solutions at network edge enabling upgrade to high-value Software Defined Radio (SDR) platform for Mission Critical IoT (MC-IoT) applications.

Ondas Networks’ customer end markets include (1) utilities, (2) oil and gas, (3) transportation (especially rail), and (4) government entities whose demands span a wide range of mission critical applications that require secure communications over large and diverse geographical areas, many of which are within challenging radio frequency environments.

Fog is another layer of a distributed network environment and is closely associated with cloud computing and IoT.

Fog computing and edge computing are effectively the same thing. With Fog computing, the data is processed within a fog node or IoT gateway which is situated within the local area network (LAN).

As for edge computing, the data is processed on the device or sensor itself without being transferred anywhere.

Ondas holds 14 patents (6 issued in the U.S., 7 pending in the U.S., 1 pending internationally).

The company claims that its thirteen years of software development provides a first mover advantage along with ownership of two IEEE standards (the rules and guidelines that define communication for wireless LANs).

Thematics

The company is going after the rather non-sexy (but large) markets driven by rail / transit, drones, utilities, transportation, public safety, oil & gas, security, and aviation.

We can start with four images to demonstrate the thematics.

The U.S. rail system stretched across almost 150,500 km, making it the largest network in the world in 2018.

Railroads include railway routes that are open for public passenger and freight services and excludes dedicated private resource railways and parallel tracks.

Length of rail track in selected countries (Statista)

By 2025, the commercial drone market is expected to generate just over $12.5 billion U.S. dollars in global revenue. That market will need a network.

Projected commercial drone revenue worldwide (Statista)

But to truly scale, drones must be able to fly without a pilot, and certainly BVLOS.

There is only one entity that can do that per the FAA, and it’s owned by Ondas.

In this realm, Ondas owns both the network and the drone.

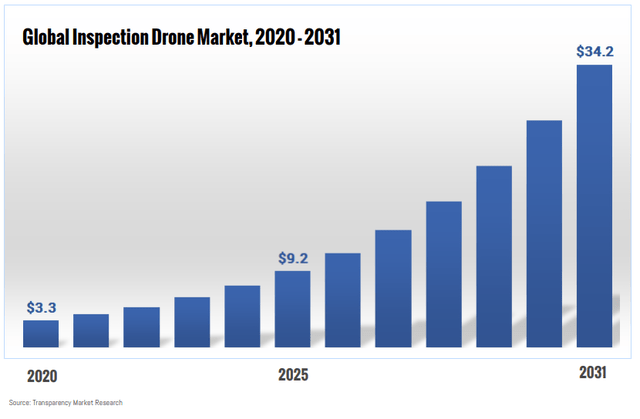

AR sees the global inspection drone market growing to over $34 billion by 2021.

Global Inspection Drone Market (American Robotics)

By 2025, the number of IoT connections in North America is forecast to grow to 5.9 billion.

Number of IoT connections in North America (Statista)

In 2022, the global market for land mobile radio systems is projected to reach 25.3 billion U.S. dollars.

Size of land mobile radio systems worldwide (Statista)

LMR is essentially push-to-talk two-way walkie-talkies. This is the main communication method for mission-critical industries due to its secure and instant communication method along with location tracking.

LMR systems are growing to become insufficient and need upgrades due to increased data requirements for applications like video and VoIP.

Of particular interest right now is rail and the company is confident that its first large revenue bookings should come in the back half of 2021 in this segment.

These underserved markets deal with complex and often difficult to connect regions which are, nonetheless, mission critical, often times sending life and death communications, like a locomotive moving at 50 MPH crossing a street.

The legacy narrowband, which still prevails today, uses land mobile radio (like walkie-talkies), low-speed dial up Internet, and supervisory control and data acquisition (SCADA).

Ondas, however, is turning this industry toward what they refer to as “mission critical broadband.”

It’s this disruption that allows for the Internet of Things (IoT), Fog (or edge) computing, sensor networks, and land mobile data radio (LMDR) in still limited bandwidth regions.

Legacy systems can provide low bandwidth Advanced Train Control System (ATCS) but cannot support onboard telemetry, voice, or positive train control (PTC).

The Ondas fog cloud, through the FullMAX software platform, delivers ATCS, but also onboard telemetry, voice, and PTC.

Class I freight rail upgrade for ATCS with the company’s FullMAX platform embedded is one of the most likely areas for the company’s first large billings and revenue in the second half of 2021.

The company is not shy about its technological superiority stating that it is the “first and only solution to enable mission-critical IoT (MC-IoT) applications for key infrastructure markets, constrained by legacy narrowband private networks.”

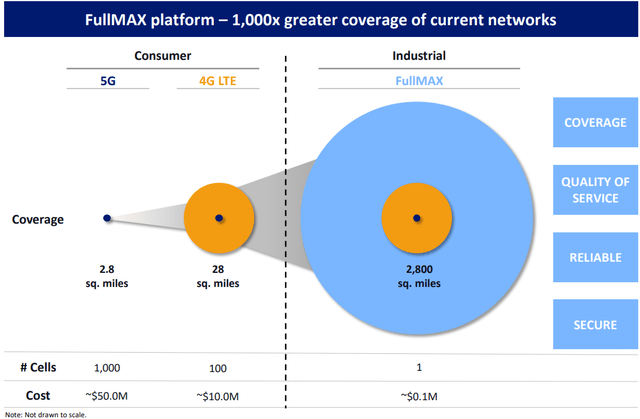

The company has its “FullMAX” platform which provides 1,000 times greater coverage of current networks.

Here is an image that the company shares:

FullMAX Platform (Ondas Networks)

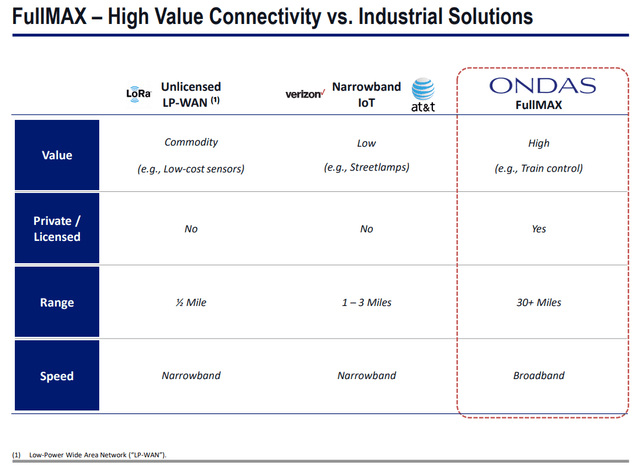

It then compares FullMAX to legacy networks in the next image, highlighting that it is the only solution with private / licensed networks, a range of 30 miles, far in excess of the narrow band 3-mile range, and broadband speeds.

FullMAX High Value Connectivity (Ondas Networks)

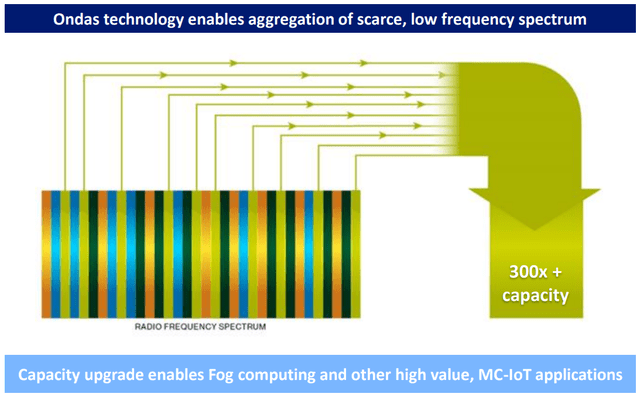

In short, Ondas claims that its technology enables aggregation of scarce, low frequency spectrum.

Ondas Capacity (Ondas Networks)

The total addressable market (TAM) is substantial. These numbers come from its public filings:

-

Electric Utility $15bn global market by 2021

-

Land Mobile Radio $32bn global market by 2027

-

Oil & Gas $5bn global market by 2022

-

Railroads Expected PTC spend $10bn

-

Drones $43bn in commercial spend by 2024

But, while the TAM reads as large, the appropriate market sizing focuses on specific areas.

-

The utilities segment will be a focus on smart grid networks for electric, gas, and water.

-

The oil and gas segment will focus on pump control sensor networks on oil fields and off-shore drilling.

-

The security segment will focus on borders, and ports for government use.

-

The public safety segment will focus on its LMDR used by law enforcement and fire safety.

-

The aviation segment will focus on AeroMACS, which is for airports and for drones.

In a calculation done by the company, it claims that a 5% productivity increase in railroad productivity would translate into $4.5 billion of additional revenue for those same railroads.

But the market size is not the only compelling factor.

Catalysts

The first catalyst is return on investment (ROI).

Companies that rely on data and private networks face risk if they do not meet the highest standards available to them.

As for the second catalyst, even beyond ROI, freight rail has required upgrades by 2023 as mandated by the FCC.

This isn’t the part of technology that people will tweet about, or even speak about on CNBC, but it is a large and underserved market and anything measured in tens of billions of dollars that may be facing a disruption that can be addressed with a recurring revenue software model is worth taking note of.

We don’t need the sexy; we need the thematics, the product, the moat, and the underappreciation by financial markets.

A common network is needed to connect all seven of the class I railroad companies.

The company expects commercial adoption beginning with 900 MHz network in 2022 (this year).

Third, the Federal Aviation Agency (FAA) faces a drone bottleneck.

AURA Network Systems plans to develop and manage an FAA-approved nationwide UAS Command and Control (C2) network.

As AURA pushes to make a market, it will rely on Ondas’ platform, since AURA Network Systems uses the Ondas Software Defined Platform and Ondas embedded software.

This is very much a case of the pick-axe to the gold rush, where Ondas is the guts that makes AURA’s vision possible, and so too Ondas will reap ongoing rewards for AURA’s success.

When we now add American Robotics, we’re starting to move toward a total domination strategy in the drone market. (We said starting!)

Ondas’ FullMAX platform aims to provide standards-based system to avoid expensive and time-consuming development of proprietary SDR systems, lower infrastructure costs, and allow more on-network drones per tower location.

FullMAX goes on to fit in the solutions for a comprehensive MC-IoT software-based solution as well as an SDR Platform.

Again, this would be, in part, a recurring revenue software as a service product with ongoing software upgrades and maintenance.

Partnerships

Ondas has partnerships with large players in the ecosystem including Siemens, AURA, JVCKENWOOD (OTCPK:JVCZY), and IAI.

Siemens

In May 2020, Ondas announced a partnership with Siemens Mobility to integrate its FullMAX platform into Siemens’ Advanced Train Control System (ATCS) products for the North American Rail Industry and also deploy ONDS’ edge radio and base stations.

The portfolio will feature new radios that are interoperable with Siemens Mobility’s extensive installed base of ATCS radios. Importantly, the new radios will be MC-IoT capable, ensuring the railroads are ready to embrace future advanced train control, signaling, crossing and monitoring applications.

Ondas’ will provide the technology and Siemens will sell to its large installed base systems under its Airlink brand name.

As if the Class I rails weren’t enough, on July 7th Siemens announced that it had been awarded a historic $3.4 billion in contracts from Amtrak.

Class I rail is reserved for cargo, but if we remove that requirement, Amtrak would qualify, in size, as a Class I.

The contract includes, in part, ‘predictive maintenance technology and real-time digital monitoring.’ That sure sounds like it will need a network.

JVC Kenwood

JVC Kenwood and Ondas have partnered to design an upgraded LMR system (walkie-talkies) using the FullMAX platform for the 160MHz spectrum band.

Even further, both companies look to extend LMR systems using FullMAX to adjacent verticals like public safety (police and fire).

Aura Network Systems

Aurora plans to develop and manage an FAA-approved nationwide drone network that will use FullMAX for aviation.

American Robotics

And of course, we must discuss American Robotics (AR).

AR is a leading developer of fully-automated commercial drone systems and the first and only company approved by the FAA to operate its drones beyond-visual-line-of-sight (“BVLOS”) without a human operator on the ground.

In the press release, we did get this:

American Robotics brings together best-in-class IP, a Robot-as-a-Service business model, and its historic FAA approvals to deliver an industrial drone service capable of unlocking the $100 billion commercial drone market.

We cannot stress how crucial BVLOS non-pilot usage is for the drone industry.

Without it, this industry would suffocate on costs and lack of use.

It’s far too expensive to have a pilot fly drones at scale, and it’s also nearly impossible, even with a pilot, to gain the value of a drone without going BVLOS.

In short, from an AR presentation in September 2021, we learned this:

-

Each Scout would be sold at $50,000 annual recurring revenue (ARR) in a five-year contract, totaling $250,000 in total contract value (TCV) for each sale.

-

Unit economics are such that each sale will provide a substantial 71% free cash flow margin.

-

The company guided to a total addressable market (TAM) for its AR division of $115 billion, encompassing the industrial, agriculture, and defense markets.

-

2022 guidance of more than 50 units sold and delivered in 2022, more than 800 units in 2024, and more than 4,000 units in 2026.

-

The guidance translates into annually recurring revenue of at least $2.5 million, $40 million, and $200 million in 2022, 2024, and 2026, respectively, with a 71% free cash flow margin.

Q4 Updates Were Substantial

We finally got our guidance for 2022 for the rail side of the business, coming in at $20 million in bookings, which would be about 10-fold higher than last year.

We also learned that a second class I rail has signed a purchase order with Siemens for Ondas’ network and radios, that a third will sign by Q2, and that the company has guided to having five of the six class I rails by the end of this year.

These are huge accomplishments and, while we were always bullish on the Ondas story, we had to look at it with a skeptical eye.

This news on the class I rails is potentially entity changing, and Ondas actually noted on the earnings call, in response to my question, that rail as a business will be self-funding by the end of 2022 and 2023, and even profitable.

With five of six class I rails expected by 2022, and with proof of two already having joined, we actually feel more comfortable with what we thought were ethereal estimates for rail.

This was as good a report on rail as can be expected with such a speculative company: profitable by year-end and with five of the six mega rails — there wasn’t a whole lot else to hope for.

The drone side (American Robotics), also delivered good news.

The investor presentation given in Sep 2021 had multi-year guidance for AR, and 2022 read that they would receive orders for more than 50 drones.

On the call, we learned that 30 are already under contract, just two-months and 22 days into 2022. This feels like the company is well ahead of schedule.

All CML Pro members have access to the interview I held with the senior technologist at Chevron yesterday.

When I asked the CEO on the earnings call, he said that $100 million in rail revenue by 2024 was about right. When we add guidance for AR, we are left with ~$150 million in 2024 revenue, leaving the company trading at about 1.5x 2024 revenue with triple-digit growth rates.

Finally, yesterday Ondas announced a definitive agreement to acquire Ardenna to offer comprehensive monitoring, inspection and data analysis solutions to the Rail industry.

This was a nice surprise in that it is really the first time we have seen the possible synergies between Ondas and American Robotics since the AR acquisition.

We have heard the right words, but have never seen any actual motion. This counts as motion, or at least, the beginning of motion.

An excerpt from the press release reads the following:

This strategic acquisition will equip American Robotics’ drone solution with the necessary offerings to enhance value to the rail industry and achieve commercial scalability in the sector.

With the acquisition of Ardenna, American Robotics will begin to work with major rail industry companies, including Ardenna’s current customers which are amongst the largest freight railroad networks in North America.

In all, this was an excellent earnings report.

Some of the risk has alleviated (it’s still high) due to business success, and the AR business, too does appear to be hitting on all cylinders.

Ultimately, Ondas is still a speculative investment, in our opinion, and while it may be appropriate for some investors, it is not appropriate for all.

That personal decision, however, is beyond our purview.

Caution

This, in whole, would be the Ondas story and it’s so early, it’s not yet written.

It’s not the price today that we’re after, it is the possibilities that exist over the next several years that has our interest, and a stock price today means very little to us, as we focus on the stock price in 5-years.

This is a small company and as such can see truly large stock gyrations making it possibly inappropriate for some investors.

Ondas reported less than $3 million in total annual revenue for 2021 and as of earlier in 2021, was an over-the-counter stock, and only recently moved to the NASDAQ National Market (NNM).

The risk is so great and the liquidity so small, that there is no other way to invest in such an entity without patience.

This is a decade long story, and there is substantial risk that this company never makes it to the five-year mark.

To have a fear of missing out is to have a mindset that is antithetical to everything that CML Pro stands for — perspective and long-term thematics which in turn lead to a higher investing IQ.

Risk

It’s difficult to know where to start a conversation about risk with a company this size.

Is product-market fit the largest risk, or is it the thematic?

Is it management’s unproven track record, or is it the industry’s legacy history of poor innovation?

-

Will this company have a stock price above $0?

-

Will the company deliver bookings in the near future (2024) not just at the $40 million – $50 million level likely to be shown in 2023 (a 20-fold from 2021), but at the level that for most of the world is considered table stakes to be a public company — $100 million?

With Ondas, the path is less clear to outsiders, and even if the path is traversed, we are looking at two years to just reach a semblance of legitimacy of even $50 million in revenue.

Then, certainly, we must consider the risk of better funded and connected competitors, product-market fit, and management’s ability to execute.

These are all legitimate risks and each is substantially elevated in a company so small.

Conclusion

Today, we maintain our Top Pick status on Ondas fully aware of a long road ahead, one which may well end up in a dead end; busted.

But, reports like today are extremely bullish and we are much more comfortable with the company.

Certainly, our CEO conversations will influence our stance, one way or the other.

Thanks for reading, friends. Stay safe.